snohomish property tax due date

July 1 2016 - September 30 2016. Proposition 8 decline-in-value occurs when the current market value of your property.

Printed Map Gallery Everett Wa Official Website

20212022 secured property tax bills will be mailed out during the month of October 2021.

. Types of county reports include. Page which may be viewed from the Board of Equalizations website at. City tax rates and information including sales tax use taxes lodging tax real estate excise tax and utility tax.

State Sales and Use Tax. Taxes Tax Statistics For rate questions visit Washington State Department of Revenue or call 800-547-7706. Whether you are already a resident or just considering moving to Snohomish County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Learn all about Snohomish County real estate tax. The Pierce and Snohomish county treasurers are also. Name or Address Changes Is your name and address correct.

If paying after the listed due date additional amounts will be owed and billed. Retail Sales Use Tax. Snohomish County Government 3000 Rockefeller Avenue Everett WA 98201 Phone.

Property taxes levied for the property tax year are payable in two installments. City tax rates and information including sales tax use taxes lodging tax real estate excise tax and utility tax. No interest will be charged on payments received by that date.

16 rows Important Assessment Dates Snohomish County WA - Official. Full year or first half taxes must be paid by April 30th otherwise the entire tax becomes due subject to seizure and additional costs. October purchases must be paid by November 30 while November purchases have a due date of December 31.

FAQs What are delinquent taxes. Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined. After that date interest charges and penalties will be added to the tax bill.

Spokane County has extended the deadline to June 15 th 2020. Skip to Main Content. A 25 percent discount is allowed for first-half property taxes paid before September 1 and for second-half property taxes paid.

Local City County Sales and Use Tax. State Sales and Use Tax. Skip to Main Content.

Snohomish WA 98291-1589 Utility Payments PO. Regional Transit Authority RTA. The Department of Revenue oversees the administration of property taxes at state and local levels.

The second installment is due February 1st and delinquent if not paid by 5 pm. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information. Enter Any Address Receive a Comprehensive Property Report.

State Sales and Use Tax. Box 1589 Snohomish. December 1 2014 - December 31 2014.

FEBRUARY 1 Second installment of real estate taxes is due delinquent after 500 PM on April 10. March 30 2020 3474 Due to the financial hardships caused by the COVID-19 pandemic Snohomish County Treasurer. King County property owners who pay their property taxes themselves rather than through a mortgage lender have until Monday November 2 to pay the second half of their 2020 bill.

The first half 2022 property taxes were due April 30th 2022. 2020 PROPERTY TAX CALENDAR. Snohomish County Extends Deadline for Individual Property Taxpayers Deadline will now be June 1 2020 EVERETT Snohomish County March 30 2020 - Due to the financial hardships caused by the COVID-19 pandemic Snohomish County Treasurer Brian Sullivan and Executive Dave Somers have extended the first-half 2020 property tax deadline to June 1 2020.

The second installment is due March 1 of the next calendar year. 1201 AM on January 1 tax lien date. King Pierce and Snohomish County have extended the payment due date for property taxes to June 1 st 2020.

Ad Property Taxes Info. Snohomish County Treasurer Updates 2022 taxes are available to view or pay online here. FEBRUARY 15 Deadline for filing homeowners exemption claim 7000.

Interest andor penalty is assessed on the full amount of taxes due for the year. See Results in Minutes. Please note that 1st Half Taxes are Due April 30th and 2nd Half Taxes are Due October 31st.

PROPERTY TAX YEAR CALENDAR. If you purchase in September your due date will be October 30th with a delinquency on November 1. Local City County Sales and Use Tax.

The first installment is due November 1st and delinquent if not paid by 5 pm. General Tax Information Tax Due Dates First half taxes are due April 30 Second half taxes are due October 31 Mail processing of payments may take until May 15th for the first half and November 15th for the second half due to heavy volumes. Pay Property Taxes Offered by County of Snohomish Washington 425-388-3366 PAY NOW Using this service you can view and pay them online.

089 of home value Yearly median tax in Snohomish County The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600. Individual Program Review of a single area of property. Property Taxes Legal Resources.

Snohomish County Washington Property Tax Go To Different County 300900 Avg. In our oversight role we conduct reviews of county processes and procedures to ensure compliance with state statutes and regulations. Taxes under 5000 for the year are due in full on or before April 30th.

The date of delinquency is always one day after the due date. When summed up the property tax burden all owners shoulder is created. Enclosed is the 2020 Property Tax Calendar which identifies action and compliance dates of importance to assessing officials and taxpayers.

Please consult RCW 8456020. Due to the financial hardships caused by the COVID-19 pandemic Snohomish County Treasurer Brian Sullivan and Executive Dave Somers have extended the first-half 2020 property tax deadline to June 1. Payments received after this date will be assessed a 10 penalty.

Pierce County Assessor-Treasurer Mike Lonergan announced Monday that due date for first-half property tax payments would be extended to June 1 2020. The second half 2022 taxes are due October 31st 2022 Passport Application Processing. The first installment is due September 1 of the property tax year.

Snohomish WA 98291-1589 Utility Payments PO. December purchases are always billed for taxes due January 31st of the next year. The deadline will not be extended.

This calendar will be posted to the. King Snohomish and Thurston counties are. Government Websites by CivicPlus.

In this mainly budgetary function county and local public leaders estimate annual spending. First half tax payments made after that date will need to include any interest or penalties. Snohomish County extends deadline for individual property taxpayers to June 1 Posted.

1 Deadline will now be June 1 2020 EVERETT Snohomish County March 30 2020 Due to the financial hardships caused by the COVID-19 pandemic Snohomish County Treasurer Brian Sullivan and Executive Dave Somers have extended the first-half 2020 property tax deadline to June 1 2020.

Job Opportunities Sorted By Posting Date Descending Help Starts Here

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Property Taxes And Assessments Snohomish County Wa Official Website

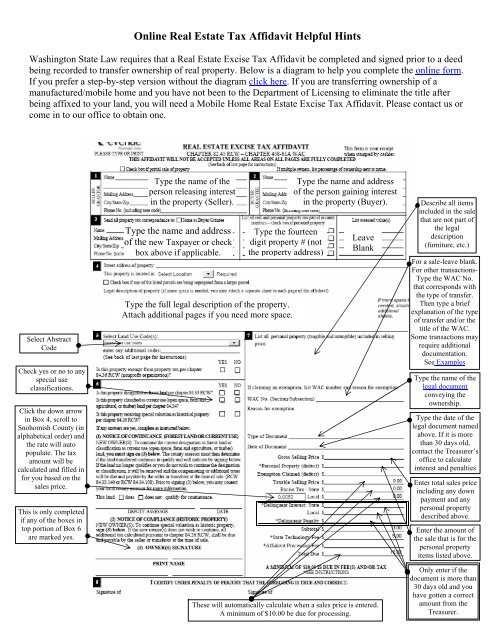

Online Real Estate Tax Affidavit Helpful Hints Snohomish County

Snohomish Weighs Tax Breaks For Affordable Homes Though Results Vary Heraldnet Com

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Property Tax Interest Snohomish County Wa Official Website

Property Tax Interest Snohomish County Wa Official Website

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Snohomish County Extends Deadline For Individual Property Taxpayers To June 1 My Edmonds News

Snohomish County Sheriff Ready To Increase Jail Population Heraldnet Com

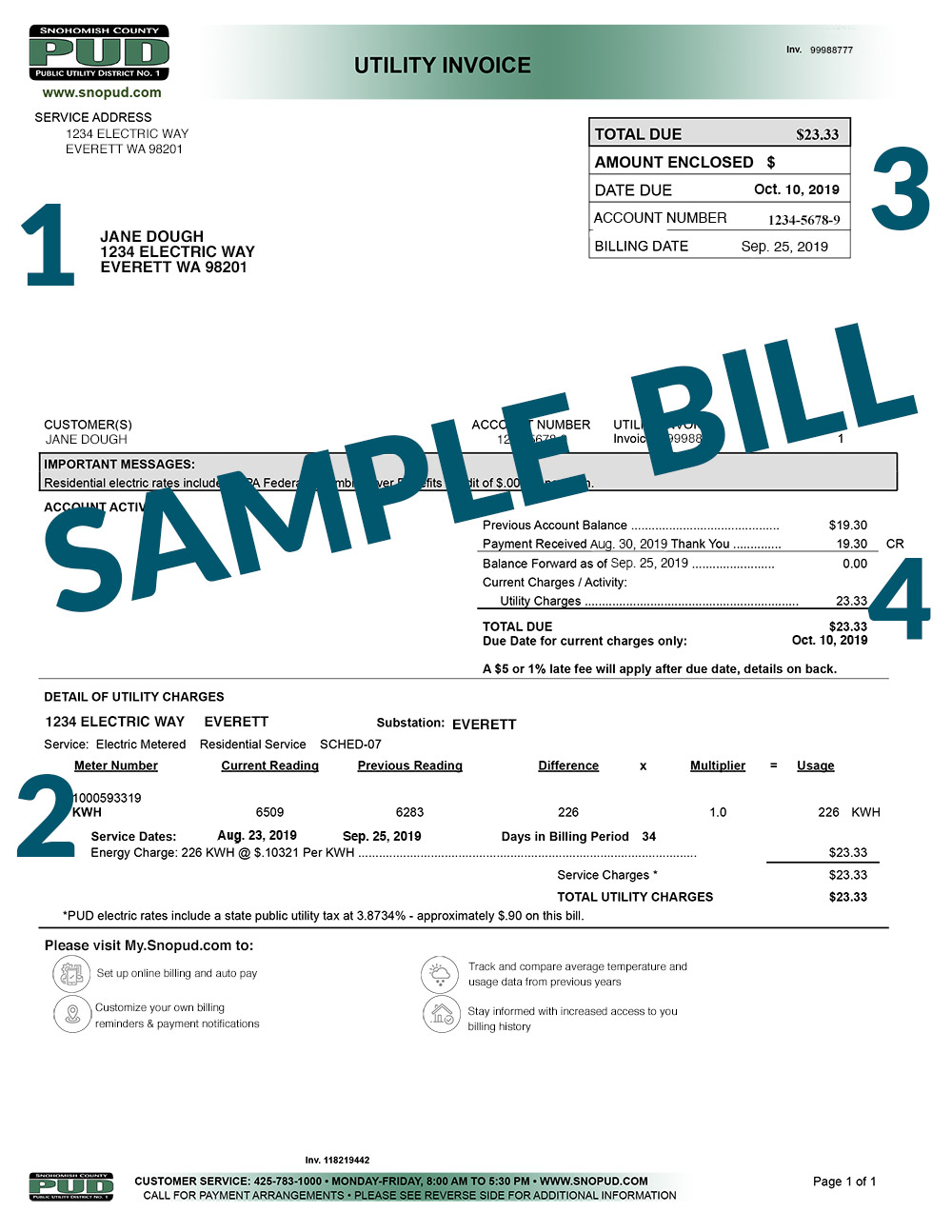

My Billing Statement Snohomish County Pud

Job Opportunities City Of Snohomish Careers

Mountlake Terrace Couple Sues Over Catastrophic Sewage Flood Heraldnet Com

Individual Property Tax Deadline Extended To June 1 Lynnwood Times