mobile county al sales tax registration

Step 1 of 4 - Company Information. For tax rate information please contact the Department at 256-532-3498 or at salestaxmadisoncountyalgov.

We Represent Integrated Network of Tax Agencies All Over the World.

. The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100 not to exceed 40000. Ad Sales Tax Registration Services. Please select the State the business is requesting for new.

2 Choose Tax Type and Rate Type that correspond to the taxes being reported. If you have questions please contact our office at. Revenue Department 205 Govt St S.

243 PO Box 3065 Mobile AL 36652-3065 Office. Nick matranga license commissioner mobile county adam bourne deputy license commissioner mobile county sales tax department 3925 michael boulevard suite f p. Please Select State Sales Tax Registration Required.

Online Forms Motor Vehicles Business License Sales Tax. The Online Renewal System allows you to. The Property Tax Division is responsible for advising and assisting county tax officials on departmental policies procedures and the laws of the State of Alabama concerning the.

If any of these situations apply to you please visit your local License Commissioner Office to update your information and process your renewal. Tax Sales Id Number information registration support. 800 to 300 monday tuesday thursday and fridays and 800 to 100 wednesdays.

Please call the Sales Tax Department at 251-574-4800 for additional information. Access directory of city county and state tax rates for Sales Use Tax. Which Involves the collection of monthly Sales Use Taxes.

If paying via EFT the EFT payment information must be transmitted. The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales. Last sales taxes rates.

That means the total sales. In mobile or our downtown mobile office at 151 government st. Vendor Registration Payment Center Tax Payments Bids Real Estate Listings Auctions Financial Reports Revenue Department.

Instructions for Uploading a File. 150 minimum for each registration year renewed as well as 100 mail fee for decals. Our Experienced Highly Qualified Team is Ready to Help.

Tax Sales Id Number information registration support. Ad New State Sales Tax Registration. In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal.

251 574 - 4800 Phone. Electronic copies of registration certificates. Restaurants In Matthews Nc That Deliver.

Section 34-22 Provisions of state sales tax statutes applicable. Mobile County Al Sales Tax Registration. Revenue Office Government Plaza 2nd Floor Window Hours.

Vendor Registration Payment Center Tax Payments Bids Real Estate Listings Auctions Financial Reports Revenue Department. Once you register online it. Mobile AL 36652-3065 Office.

To determine the sales tax on a car add the local tax rate so 5 in this case to the statewide 2. ALABAMA State Sales Tax 2 State Taxes are Reciprocal County Taxes Varies 1 - 383 Total of. See information regarding business licenses here.

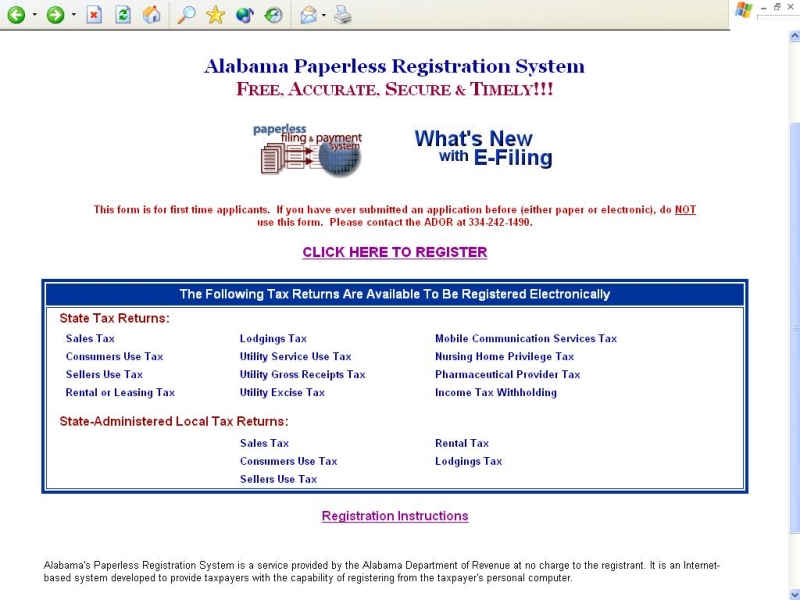

Per 40-2A-15 h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self. Mobile County Sales Tax Form. Business Tax Online Registration System.

Ad New State Sales Tax Registration. Upon the proper completion of a Motor Fuels Gas Excise. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types.

3 If you are an established. 10 rows Alabama Legislative Act 2010-268 now mandates that customers using a Visa or. Opry Mills Breakfast Restaurants.

The calculator then displays a 5 auto tax rate. NOTICE TO PROPERTY OWNERS and OCCUPANTS. In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return.

Access detailed information on sales tax holidays in Alabama.

Daily Devotional Devotions Math Equations

Daily Devotional Devotions Math Equations

How To Become A Loan Signing Agent In Missouri Loan Signing Agent Loan Signing Notary

Should You Be Charging Sales Tax On Your Online Store Backoffice

How Waffle House Is Used By Fema To Assess Damage Waffle House Hurricane Prep Hurricane Preparation

Woolworth Register Receipt From 9 28 1996 Store 2280 Blue Ridge Mall Kansas City Mo Kansas City Blue Ridge Kansas

Create And Manage Sales Tax With Square Youtube

Sales Tax Mobile County License Commission

We Re Having A Free For All At Lagniappe Home Store We Have A Huge Selection Of Brand Name Furniture Mattresses And Home Accents At The Best Prices In Town A