are inherited annuities tax free

Technical Tax Rules for Inherited Non-Qualified Annuities. In that instance any taxes owed on distributions would be deferred until you receive them.

Annuity Beneficiaries Inheriting An Annuity After Death

If the beneficiary is the spouse of the annuitant the spouse can change the contract into his or her own name.

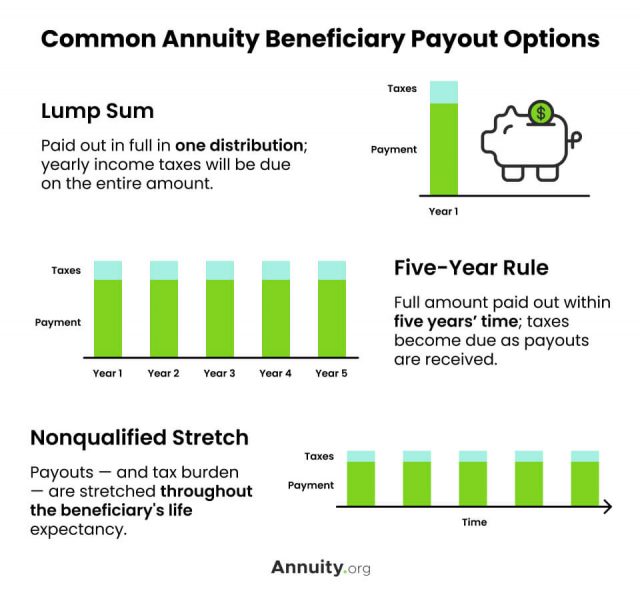

. The beneficiary of a tax-deferred annuity may choose from several payout options which will determine how the income benefit will be taxed. The assets are transferred into an Inherited Roth IRA held in your name. A final option is spreading payments out over the beneficiarys lifetime.

Employers are not required to match the amount and the employee is responsible for the entire amount of the extra tax. Open an Inherited IRA. Generally the death of the holder owner of a non-qualified annuity terminates the contract and required.

One of the benefits of annuities is that. As the annuity grows over time the capital gains generated by the underlying funds are not taxed. Undistributed assets can continue growing tax-free.

Deferred Annuities vs. Named the Additional Medicare Tax it adds an additional 09 percent tax on top of the 145 percent employees have to pay. After a change in ownership the contract.

There are certain technical rules that apply to the post-death distribution methods described above. But the way the IRS now treats a longevity annuity within a tax-deferred retirement account such as an IRA or 401k has changed. Then again you might wind up losing a significant amount of money if the real estate market is flat or your business doesnt do as well as you hoped.

So the person who inherited the annuity can receive a guaranteed lifetime that will also spread out the tax liability. A spouse does not have to pay estate tax on. Those who inherit an annuity may find this to their advantage as it is the polar opposite of the conventional rule.

Annuities come in several forms the two most common being fixed annuities and variable annuities. If youve inherited an annuity you often must make a decision about your death benefit quickly. If your inherited money comes from a retirement account to which pre-tax dollars were contributed state and federal income tax on the money has not yet been paid.

A spouse who inherits a Roth IRA need never take any distributions which in any case would be tax-free. Generally the death of the holder owner of a non-qualified annuity terminates the contract and required distributions. Inherited annuities are taxable as income.

The tax liability and penalties you incur by cashing in your annuities all at once could be offset by the profits from that new business or the appreciation value on a home. IRS Form 1099-R Distributions from Pensions Annuities Retirement or Profit Sharing Plans IRAs Insurance Contracts etc is used to report all retirement plan distributions to holders of Merrill Lynch Basic SEP SIMPLE Retirement Selector Account RSA 403b7 and. Technical Tax Rules for Inherited Non-Qualified Annuities.

It is also less likely to push you into a much higher tax bracket. That money keeps working in an annuitys portfolio. A portion of each annuity payment will be considered a tax-free return of principal spreading the tax liability out over time unless you select.

Whether you have to pay the Additional Medicare Tax depends on your annual income and your tax filing. Taxes on an inherited annuity are usually dictated by your beneficiary status and how you receive payouts. You may designate your own beneficiary.

This rider will end if the policy is surrendered if annuitization income payments have begun if ownership is transferred or if the policy owners spouse continues the. Here is a short list of the most important rules for inherited non-qualified annuities. Before we delve into the details lets first explain how a QLAC longevity annuity works.

1099-R Tax Reporting Statement. Tax-Deferred Annuities TDAs. Longevity annuities have been around for years.

During a recession variable annuities pose much more risk than fixed annuities because their. Tax Rules for Inherited Annuities. For instance if buy the annuity for 100000 and receive 6000 annually in payments.

Examples include a 401k or an individual. Important tax reporting information to help you prepare your federal tax return. The surviving spouse would pay income tax upon selling the inherited assets based on the difference between the sale price and the stepped-up basis.

However the tax is not front-loaded. The Enhanced Beneficiary Benefit Rider is not available on Traditional IRA Roth IRA Inherited IRA and SEP IRA policies. How a QLAC Annuity Works.

The most significant advantages annuities offer are tax-deferred growth and tax-advantaged income. If youre the spouse of the original annuitant then you can choose to continue receive payments according to the annuity schedule. Its considered as a gain and is taxable.

If you use these accounts to purchase a qualified annuity it will be tax-free if you meet certain requirements. Also you must report the entire amount to the IRS as taxable income in the year you received it. Common stock investors pay tax on both capital gains and dividends if the.

Issue age for tax-qualified account is 18-90. Over that threshold the recipient must pay taxes. This offers the least tax exposure but also takes the longest time to receive all the money.

There are certain technical rules that apply to the post-death distribution methods described above. Some people who dont know any better take the cash from an inherited retirement account expecting to pocket the entire account balance. Neither is any income generated by the portfolio.

Here is a short list of the most important rules for inherited non-qualified annuities. If a non-qualified annuity is annuitized then a portion of the payment is a return of the contributions which is also tax-free. So keep that in mind.

At any time up until 1231 of the tenth year after the year in which the account holder died at which point all assets need to be. Therefore the surviving spouse would pay income tax on asset appreciation after the first spouses death at the capital gains rate of approximately 20 2021. An annuity funded by.

The annuity that makes up a QLAC isnt a new idea. In this instance you can deduct the amount the deceased individual paid for the annuity as a tax-free return of capital.

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Annuity Beneficiaries Inherited Annuities Death

Inherited Annuity Tax Guide For Beneficiaries

Offset Taxes On Inherited Iras With This Annuity Annuity Inherited Ira Ira

Inherited Annuity Tax Guide For Beneficiaries

Annuity Taxation How Various Annuities Are Taxed

Annuity Tax Consequences Taxes And Selling Annuity Settlements